One of the easiest metric to calculate and one where most financial sites provide, earnings per share (EPS) is one of the most important measure of a companies strength. Obviously, the higher this number, the more money the company is making.

Calculating EPS

To calculate this ratio, simply divide the company’s net income by the number of shares outstanding during the same period. If the number of shares out in the market has changed during that period (ex. a share buyback), a weighted average of the quantity of shares is used.

Importance of EPS

The significance of EPS is obvious, as the viability of any business depends on the income it can generate. A money losing business will eventually go bankrupt, so the only way for long term survival is to make money. Earnings per share allows us to compare different companies’ power to make money. The higher the earnings per share with all else equal, the higher each share should be worth.

EPS is often considered the single most important metric to determine a company’s profitability. It is also a major component of another important metric, price per earnings ratio (P/E).

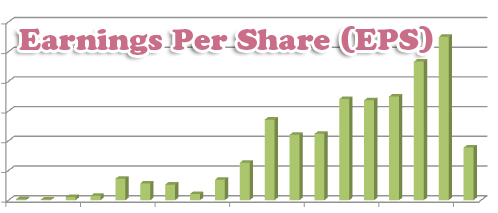

When we do our analysis, we should look for a positive trend of EPS in order to make sure that the company is finding more ways to make more money. Otherwise, the company is not growing and thus should be considered only if you are confident that it can at least sustain its income.

What to Watch Out For

Sometimes, there will be one-time events that will either benefit or hurt the earnings per share. For example, a company get a one-time tax break from the government that will benefit the earnings tremendously. These events, while contribute to the bottom line, should be taken out of our analysis because it will shrew the trends.

Lasting Thoughts

Nowadays, financial websites already have earnings per share calculated so there is no reason for us not to take a look at it in our analysis. One important point to remember is that while websites provide this automatically, it may be different (due to timing of the calculation, whether it is forward, trailing EPS etc). Therefore, it is important to do your own calculation when doing a comparison of two companies to make sure you understand fully how the numbers are calculated to avoid big surprises.

You may also want to check out this article on the same subject: Anticipating Earnings Per Share (EPS).

Promote or Save This Article

If you like this article, please consider bookmarking or helping us promote it!

If you like this article, please consider bookmarking or helping us promote it!

Print It | Email This | Del.icio.us | Stumble it! | Reddit |

Related Posts

- Anticipating Earnings Per Share (EPS)

- Price to Earnings Ratio (P/E)

- Best of Investing School – November 2008

- What is Share Repurchase?

- Figuring Out Value Using Book Value of Equity Per Share (BVEPS)

{ 4 comments… read them below or add one }

Great post. If you’re going to pick stocks, fundamental analysis is the way to do it, IMO.

I particularly like that you mention that EPS can be calculated in a few different ways. I think many people miss this completely, and incorrectly assume that two companies’ EPS can be compared as-is.

Whoa!i just graduate from P/E ratio basic knowledge to EPS.I had always been wanting to understand EPS since P/E ratios no longer give a clear picture of a Stock.In this market turnaround from sector specific to Stock Specific ,EPS ceratinly can help picking gold out of dirt.

thanks for this.

Stumbled it for good:-)

Thanks for the nice article concerning EPS. It helps me a lot to write a successful test next monday (that includes the usage and interpretation of ratios). I searched the web but I haven´t found such an clear and interesting article about this topic. Thanks a lot!

Great article. Especially useful for beginners.

{ 6 trackbacks }